100 mortgages for first time buyers with bad credit

We make the mortgage process fast easy. First-time buyers in England and Northern Ireland dont pay stamp duty on the first 300000 of property value provided the total purchase price is 500000 or less.

What Is 100 Mortgage Financing And How To Get It

The deposit you must put down or equity you already have in your home plays a crucial part in the best mortgage deals you can get.

. Postpone buying a home until youre in a stronger financial position. After this they must pay 5 on the portion of value between 300001 and 500000. Read more about Help to Buy Read more about shared ownership.

The scheme is open to first-time buyers and home movers with an annual income of less than 80000 90000 in London. Qualified borrowers will get a lightning fast preapproval letterwithin three minuteswhich is an. First-time home buyers typically finance 93 percent of their home while repeat buyers finance 84 percent.

Experian 2020 31 percent of buyers in 2021 were first-time home buyers. Buyers can choose from the 95 LTV Home Possible or 97 LTV Home Possible Advantage options. In the meantime build your credit rating back up by making repayments for bills and credit cards on time.

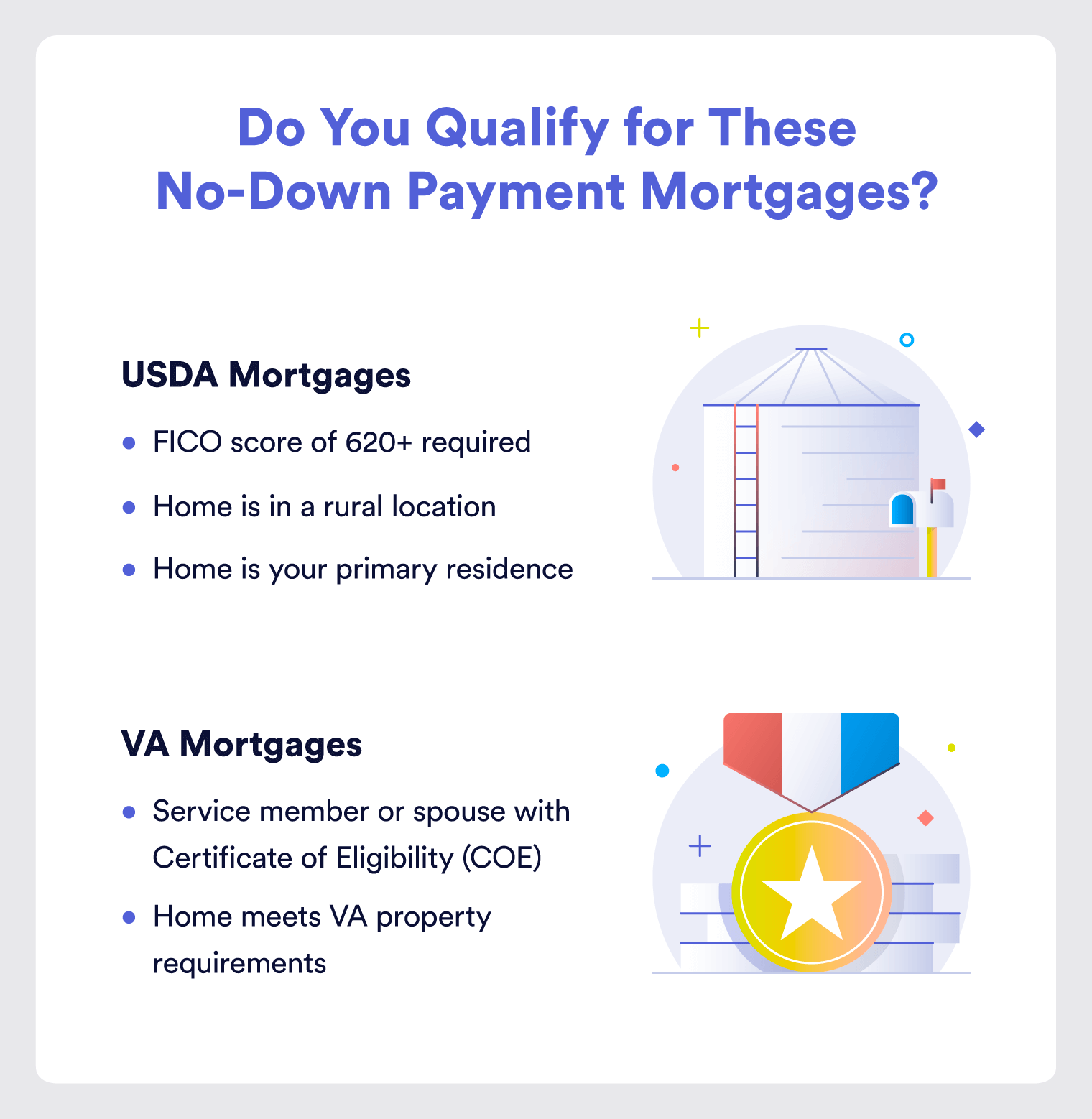

This is because USDA mortgage rates are discounted as compared to. Take some steps in the months before you apply for a new mortgage to increase your chances of being accepted. How to get a mortgage with bad credit.

Both come with flexible terms and low down. Using a USDA loan buyers can finance 100 of a home purchase price while getting access to better-than-average mortgage rates. Better mortgages for.

Home equity loans with bad credit. In the US the Federal government created several programs or government sponsored. This mortgage is ideal for low to moderate-income borrowers in underserved communities.

First-time buyers can take advantage of Fannie Maes HomeReady loan which requires 3 down. In 2020 there were 238 million first-time home buyers. Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders.

Compare 95 LTV Mortgages. A first-time buyer usually needs a deposit between 5 and 25 of the price of the property. Bad credit car loans arent offered by all financiers but there are still many lenders who can work with you to help you purchase the car youre looking for.

How to Buy a House With Bad Credit. Compare 100 LTV Mortgages. You can still find a 100 mortgage if youre a first-time buyer but its likely to be a guarantor mortgage or a family deposit.

The higher the mortgage in relation to the value or purchase price of your home LTV the greater the risk to the mortgage lender. First-time home buyer mortgage facts. The average first-time home buyer is 34 years old.

Latest news and advice on mortgage loans and home financing. What Credit Score Do You Need to Buy a House. Their most popular program for first-time homebuyers is the Home Possible mortgage.

How much does a first-time buyer need for a deposit. A bad credit score may come about for a variety of reasons but the specialist lenders who offer these products are more focused on your ability to repay your loan in the here and now. Offer 100 mortgages to first-time buyers who have been exemplary renters ex-economic adviser to Boris Johnson says Reform of the mortgage market is needed to turn generation rent into.

You get cheaper mortgage interest rates. Are 100 mortgages available for first-time buyers. The average deposit paid by buyers using MoneySuperMarket is 18 or 50174.

Credit cards for bad credit Cashback cards Rewards cards Use abroad cards Money transfer cards Loans Personal loans Loan calculator Debt consolidation loans.

Kentucky Usda Rural Housing Loans Home Loans Home Buying Rural

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers What C Va Mortgage Loans Bad Credit Mortgage Mortgage Loans

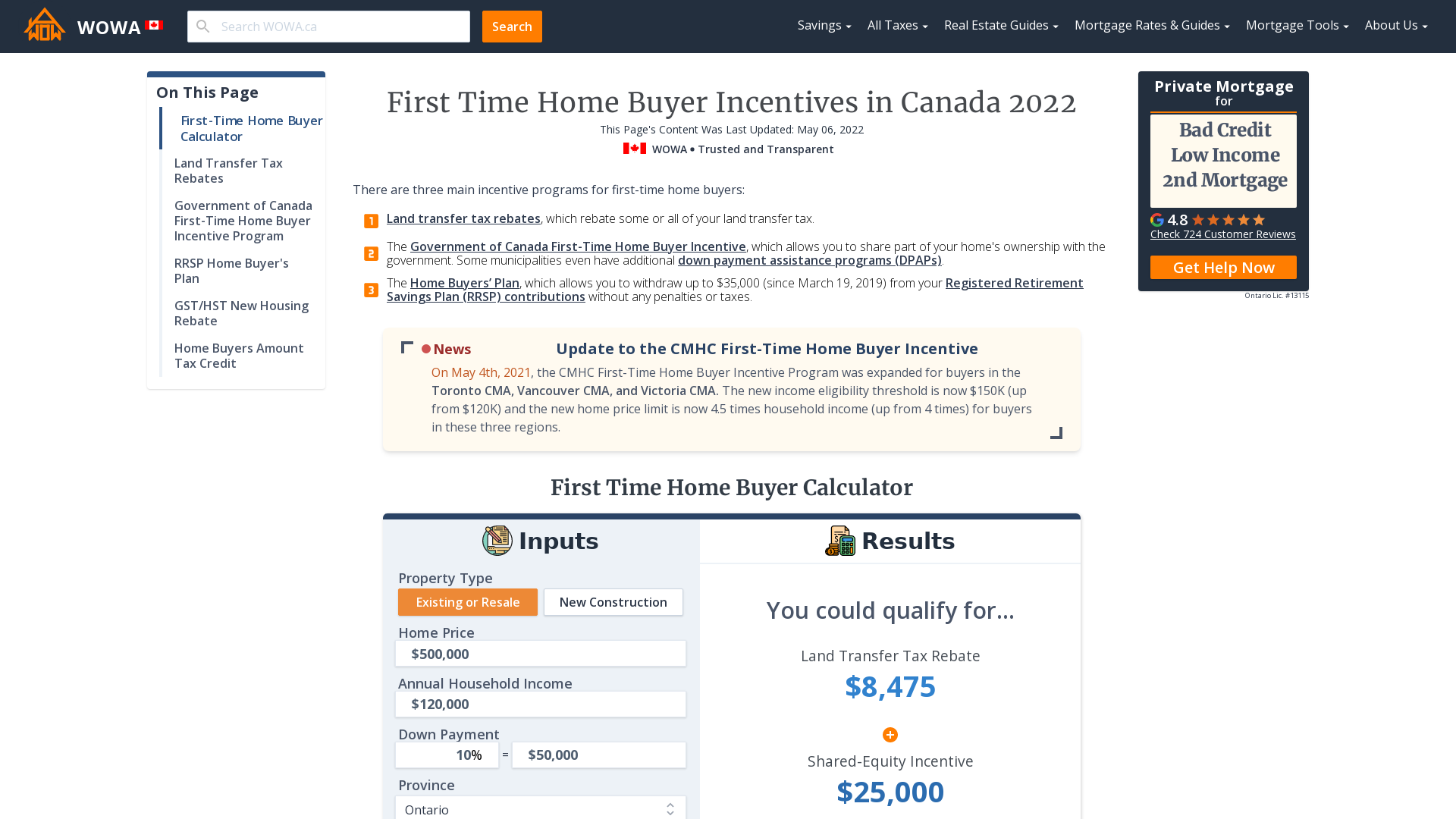

Canada First Time Home Buyers Incentives 2022 Wowa Ca

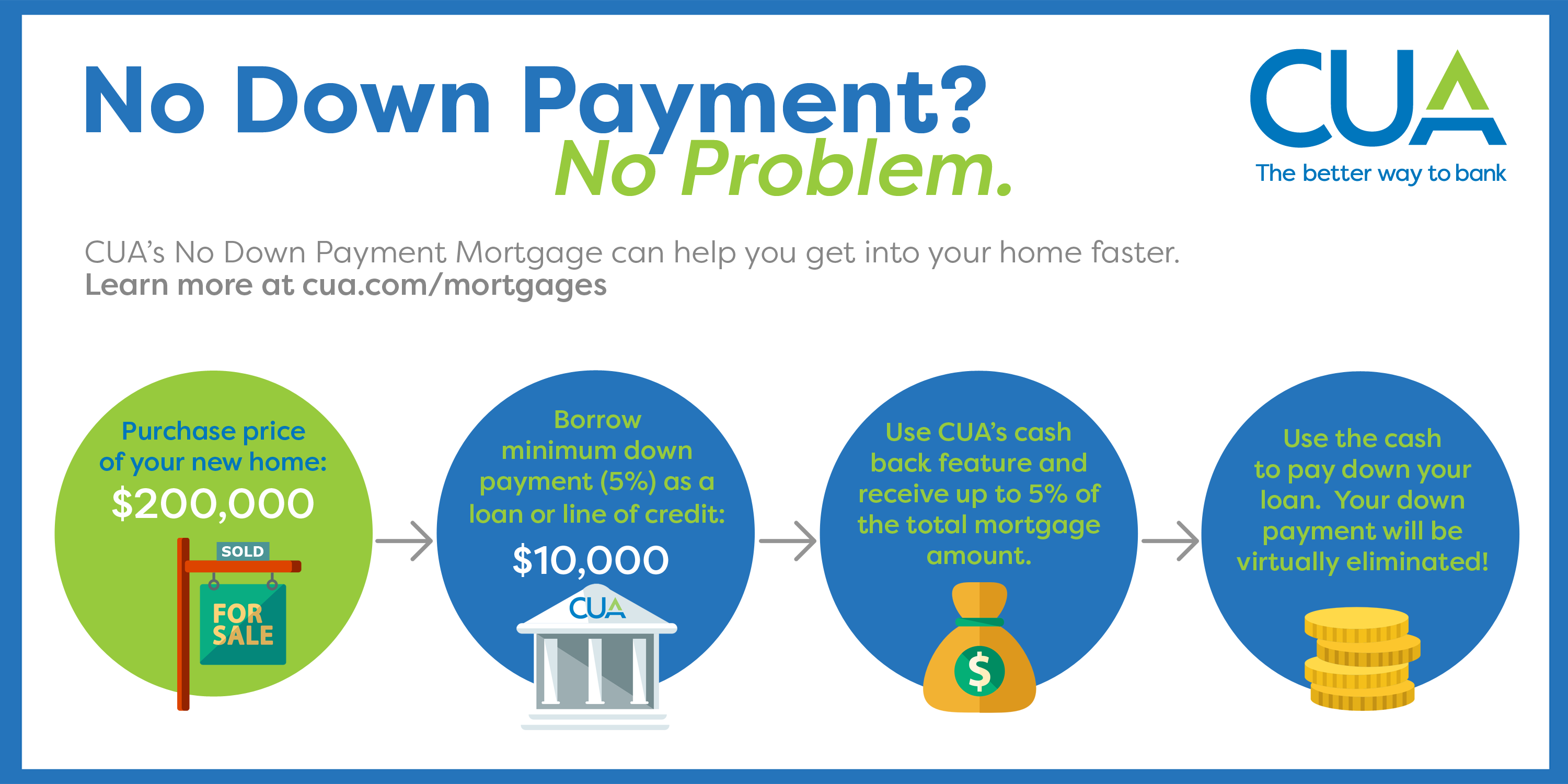

Cua The No Down Payment Mortgage

7 Quick Ways To Improve Your Credit Score Credit Score Infographic Improve Your Credit Score Credit Card Infographic

5 Steps To Get A Loan As A First Time Home Buyer With Bad Credit Badcredit Org

5 Best Mortgage Lenders For Bad Credit Of September 2022 The Ascent

Conventional Mortgage Or Fha Which Is Cheaper Mortgage Loan Originator Fha Loans Mortgage Loans

Kentucky Va Loans Offer 100 Financing Refinance Mortgage Same Day Loans Loans For Bad Credit

How To Refinance Your Mortgage With Bad Credit Greater Toronto Mortgages

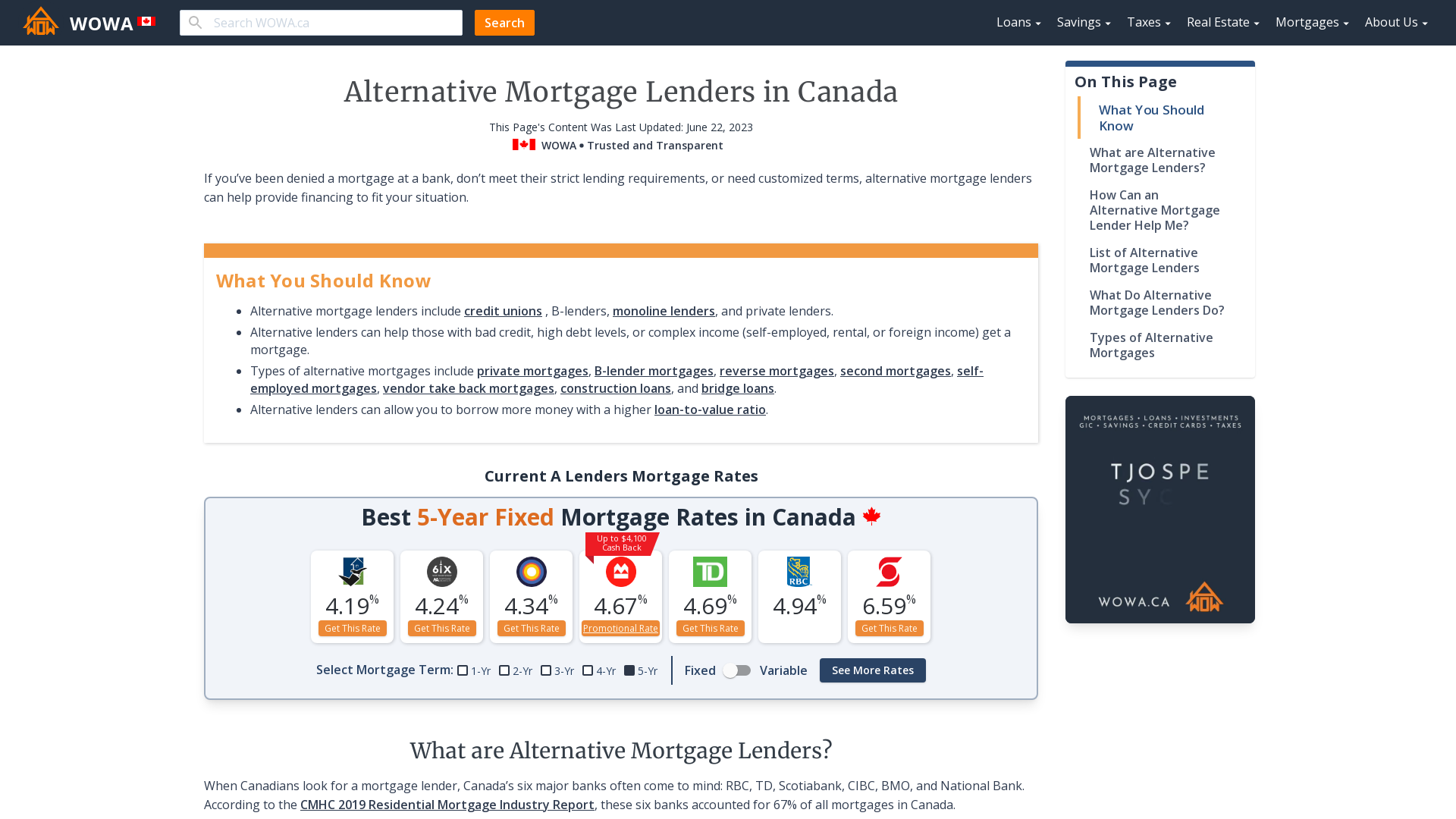

Alternative Mortgage Financing In Canada Wowa Ca

Poor Credit Mortgage Familylending Ca Inc

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers What C Loans For Bad Credit Bad Credit Mortgage Credit Score

How To Get A Bad Credit Home Loan Lendingtree

Pin On Diy Tips

Kentucky Rural Housing Usda Loan Program Kentucky Usda Mortgage Lender For Rural Housing Loans Usda Loan Mortgage Lenders Usda

Cua The No Down Payment Mortgage