34+ How much should i borrow home loan

In Singapore the LTV limit depends on your home type and the number of outstanding. A good rule of thumb is to borrow about 125 of the difference between your net college costs and the.

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

A 20 deposit will mean that you have an.

. October 28 2019. The length by which you agree to pay back the home loan. It was 525 this time last week.

1 year 2 years 3 years 4 years 5 years 6 years 7 years 8 years 9 years 10 years 11. At least one buyer is a Singapore citizen Have not taken two or more HDB loans Gross. Essentially your potential mortgage liability must be 30 of your income and all your monthly instalments must be 55 for HDB Loan.

The most common term for a mortgage is 30 years or 360 months but different terms are available depending on the type. This calculator helps you work out how much you can afford to borrow. The personal loan calculator lets you estimate your monthly payments based on how much you want to borrow the interest rate how much time you have to pay it back your credit score.

While it might be tempting to borrow whatever amount of money your lender is willing to give you its important to think carefully about how much youll actually need to borrow in order to. Mortgage Calculator Blogs. Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt.

The maximum amount you can borrow depends on factors including whether theyre federal or private loans and your year in school. Undergraduates can borrow up to. How Much Should You Borrow.

With College Ave you can borrow up to 100 of your school certified cost-of-attendance which includes tuition room board including off-campus housing. Comparing a few offers from different lenders will also help you find a better interest rate which will lower the amount you pay each month and over the life of your loan. The majority of lenders usually add at least 15 on top of their standard variable interest rate.

Add up your monthly expenses for housing. For most families the amount borrowed will fall between these two extremes. If you are borrowing for Condo.

The front-end ratio should be no higher than 28 percent of your pre-tax income 31 for FHA-backed loans. Your total monthly payment will fall somewhere slightly. Next figure out how much of this equity you can borrow.

The type of loan you choose and the current interest rates can affect how much you can borrow. But let me just share. 1 day agoThe APR on a 15-year fixed is 539.

The comparison tables below display some of the variable rate home loan products on Canstars database with links to lenders websites for borrowers in NSW making principal and interest. Income Financial standing Other eligibility requirements are. 7 hours agoBorrowers will pay about 120022 in total interest over the life of the loan.

The amount of money that a lender will need to loan you relative to the full value of a house is known as loan-to-value ratio LVR. The borrowers age. How much can I afford to borrow how much can i afford to borrow mortgage how much should I borrow.

So there is good debt so think about a mortgage a home mortgage or a student loan would be. With an annual income of 50k you will be eligible for a mortgage that is worth above 100000 but below 250000. How do Mortgage Lenders decide how much you can borrow.

Since lenders usually only let you borrow 75 to 90 percent of your home equity multiply your current home equity. 15-Year Mortgage Interest Rates Today the 15-year fixed mortgage rate sits at 534 lower than it. At todays interest rate of 536 a 15-year fixed-rate mortgage would cost approximately 810 per.

Free 55 Loan Forms In Pdf Ms Word Excel

Opting For A Home Loan From A Bank A Step Wise Guide By Nvt Quality Lifestyle Home Loans Loan Helpful

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

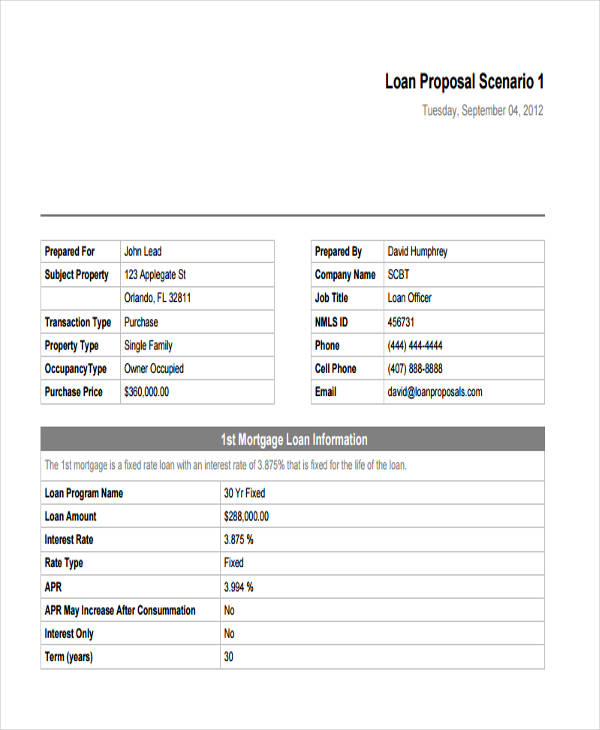

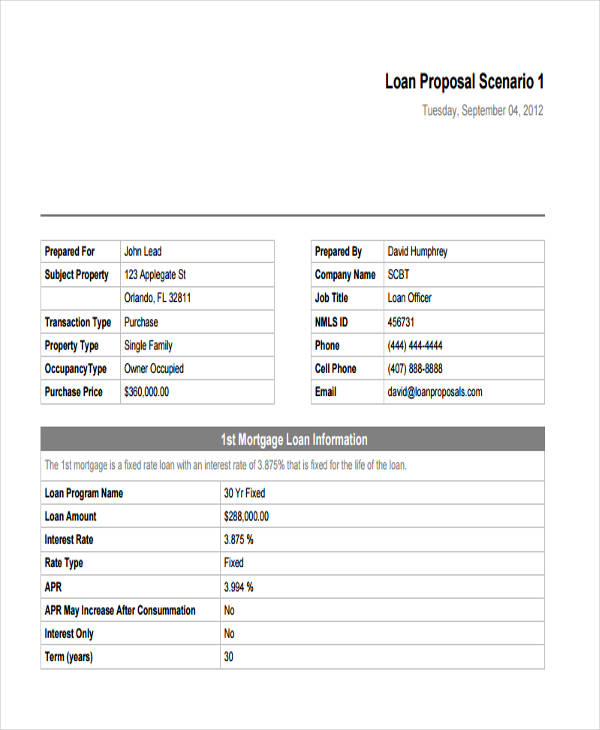

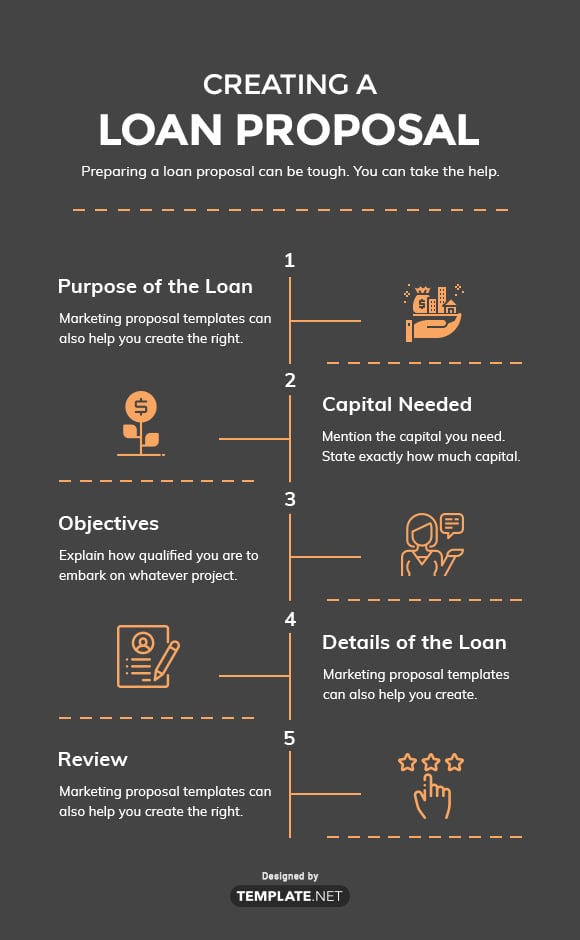

6 Loan Proposal Templates In Pdf Ms Word Pages Google Docs Free Premium Templates

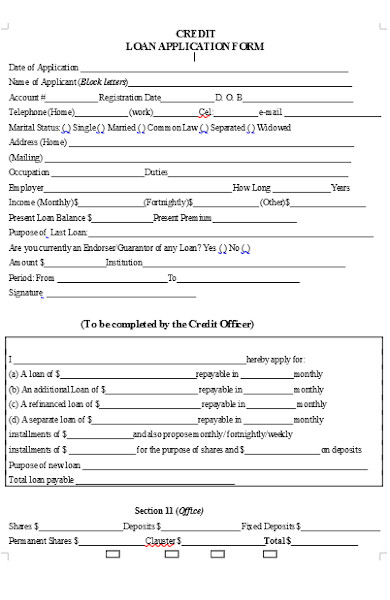

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

6 Loan Proposal Templates In Pdf Ms Word Pages Google Docs Free Premium Templates

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

Free 34 Loan Agreement Forms In Pdf Ms Word

6 Tips To Get A Perfect Home Loan Deal Axis Bank

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

Sbi Maxgain Home Loan Review With Faq S

6 Loan Proposal Templates In Pdf Ms Word Pages Google Docs Free Premium Templates

Anz 2 68 Fixed 2yr Home Loan Up To 3500 Refinance Rebate 0 3 Bundle Rebate Home Loans Investment Advice First Home Buyer

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

Feeling That Homeowner Fomo Here Are Some Tips On How To Get Started With The Home Buying Process Home Buying Process Home Buying Home Financing

14 Best Loan Company Wordpress Themes Templates 2019 Download Now Free Premium Templates

6 Loan Proposal Templates In Pdf Ms Word Pages Google Docs Free Premium Templates